After 3 years using it on every single trip, we collected quite a few stories on how to use the Wise multi-currency debit card (formerly TransferWise Borderless card)!

The Wise debit card and its multi-currency account have become a fundamental element of our travels. It is so convenient to hold countless currencies in our pocket, and to be able to control them from an app! We cannot imagine travelling without it anymore.

To complement our review and guide to requesting and using the card, here you can find some real-life examples of how to use the Wise debit card. Can you relate to them? Then you know you should get your own card (and with this link, I will get a small commission. Thank you!)!

Help me run my blog! This post contains some affiliate links: the small commission I may earn if you click through and make a purchase/booking (at no extra cost to you) will go towards supporting the site and our travels. That means more posts and useful info for you!

We only recommend products we use ourselves and believe in. Thank you for supporting Travelling Sunglasses!

Click here to read our full disclosure.

We received our wedding gift list on the Wise multi-currency account

Let’s start from the basics: there are many, easy ways of transferring money to your Wise account and card, such as bank transfer from another account, credit card, or debit card.

While planning our wedding, we decided that:

- We wanted to go on honeymoon to Japan (find the itinerary for 2 weeks in Japan here).

- We were going to use the Wise multi-currency card to have the best conversion rate to yen.

- It became natural to make our honeymoon the main wedding gift, and to receive our wedding presents straight to the Wise bank account!

We set up our wedding gift list on given2.us, a simple and clever website that allows you to create gift lists in many ways, for just 1 EUR per day. We created many categories for our honeymoon, like accommodation, food, special experiences, Harry Potter world, travel gear, etc. Our guests were able to choose a category, write a message to us, and decide the amount of the gift. Then, they would receive instructions: either give us a cash envelope at the wedding or make a bank transfer. We provided my EUR IBAN Wise account number.

Slowly, we started receiving the gifts to my Wise account, which was immediately available on the card!

We got married in July and planned to travel to Japan in October. As we planned our budget for 2 weeks honeymoon in Japan and started to book accommodations, we decided to use the Wise debit card to convert EUR to YEN. We saved some money in fees and commissions on those advance payments!

Ever since then, whenever we start planning a trip, we make a bank transfer from our Hungarian or Italian bank account to our Wise card. Opening a new currency balance is one of the first exciting steps of a new trip 🙂

As long as you have internet, you can convert and move money

Another Japan story with Wise, formerly TransferWise.

Even though we planned most big expenses in advance, we still kept some extra Euros on the account, just in case. In the evenings, we would check how many Yens we still had, what was planned for the following day, and decide what to do.

One afternoon, we were buying souvenirs and gifts in a mall, and we were spending more than we thought. I remember being on the escalator and deciding to convert some more Yen for the next purchases. It took a few seconds to open the Wise App, choose the amount in EUR, acknowledge the correct exchange rate applied by TransferWise, and convert it to YEN.

I felt so cool and technological!

You don’t actually need to convert money in advance

Yes, you can monitor the exchange rates, choose wisely a convenient day, convert a large amount of money, and pay the low commission only once.

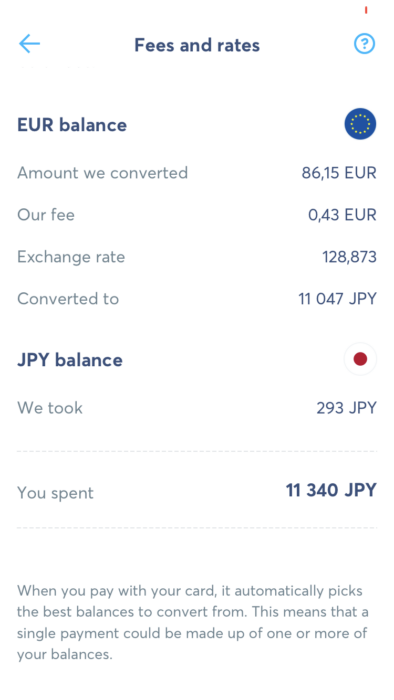

But, you can also just wing it! If you don’t have a particular currency active, Wise will take the exact amount from the most convenient currency and convert it on spot, with the usual fair exchange rate and low commission.

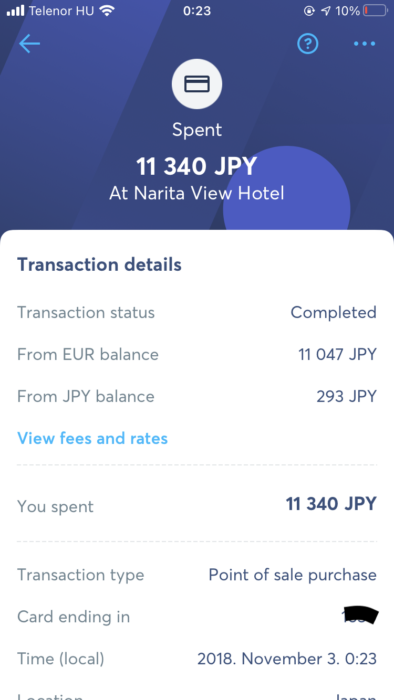

For example, on our last night in Japan, I knew I didn’t have enough Yen on the Debit card. The Hotel bill was paid with all the Yen I had, and then with some Euros converted to Yen.

Make sure you test the app and learn how to use the Wise multi-currency card before you travel.

You can buy things online with the Wise card

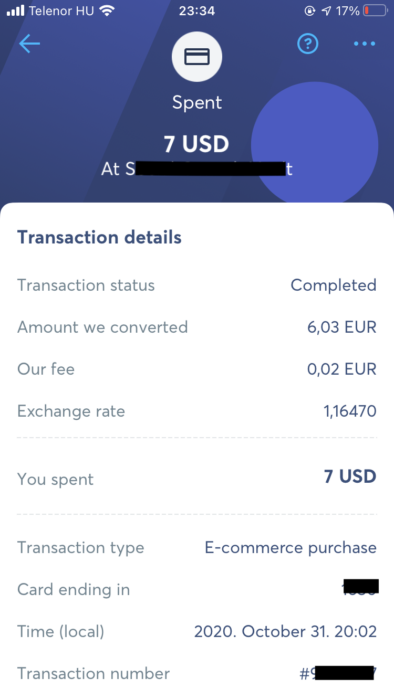

When I buy things online with my Wise debit card, they are often in US Dollars. I don’t convert a few Euros into Dollars before making the payment: TransferWise does it for me.

It’s incredibly convenient! And I’m still saving money, compared to the exchange rate fees and commissions that my bank would apply.

It’s shocking to use our regular bank card

When we went to Krakow for a weekend, Darek withdrew some Zloty with his regular bank card, in Hungarian Forints. As usual, he received a text informing him of the withdrawal amount. Something did not add up: the amount in Hungarian Forints in the text was higher than the amount of Polish Zloty he had in his hands. We calculated that that withdrawal cost him 12 EUR! We could have gotten some delicious Polish food for that!

When I set up the Polish Zloty currency in my Wise debit card, converted some Euros to Zloty, and then took cash out, I didn’t pay any commission. Ka-ching! One of the basic lessons on how to use Wise.

However, it is important to keep in mind that some ATMs may still charge fees. Also, recently Wise established that the first 200 GBP, 250 USD, 350 AUD, 350 NZD, or 350 SGD that you withdraw every month is free. Afterwards, a 2% fee applies.

You can use your Wise debit card in unexpected situations

For example, we did not know that in on the public transport in Sydney, you don’t need a pass or a ticket: you can just swipe your contactless credit card or debit card when you access the station, and when you leave it the system will charge the fare amount on your card.

So, of course, we used our Wise multi-currency card! We had our AUD account ready. We swiped, and the App acknowledged that an amount was blocked. When we reached our destination and left the station, the amount was taken. As simple as that!

I’m sure the Wise debit card can be connected to your Bolt or Uber account.

Another convenient feature is the safety section in the Wise App, where you can set limits and switch on or off different types of payments.

Their customer service is phenomenal

I had a couple of conversations by email with the Wise customer service team. They were helpful, but nowhere close to the treatment my sister Laura received.

In March 2020, Laura went on a city break to Morocco. During those 4 days, Italy and Europe freaked out and started closing the borders due to the pandemic. Their flight was cancelled, and they had to buy a new one last minute. They chose a Ryanair flight, which was sold in the local currency, the Moroccan Diram; they converted some Euro to Diram (some more than the price of the flight, to be safe), and paid with their Wise debit card.

Except that Ryanair charged more Diram than shown on the confirmation! The difference was about 30 Euro. Laura contacted the Wise customer service to ask about it: they explained that it’s something some companies do, among them Ryanair. They provided the customer service contact for Ryanair and kindly asked her to request a refund from Ryanair. Guess what? Ryanair never answered. Laura waited a week before getting back to Wise customer service; they thanked her for trying, and they refunded her the 30 Euros that Ryanair owed her!

Show some support to Laura, register to TransferWise with her link and she will receive a little bonus 🙂

Conclusion

The Wise multi-currency debit card is really useful for travel and also for everyday purchases. Now you know how to use the Wise debit card, and also when to use it!

Did you find yourself in similar situations? Then read more on our review, or request your card here (and I may receive a small commission after your first transaction, thank you!).

Do you have other interesting Wise travel stories? Share your knowledge, let us know in the comments!

We will be in Italy for 33 days. When I open the account and add money, do I add U.S. dollars and then convert them to Euros as needed? Or, do I add them as Euros now and then just get them as needed?

Hi Tom! If you have US dollars in your bank, then transfer US dollars to your Wise account. Then, within Wise, you can exchange them to Euro in advance, or you can use the card normally and Wise will exchange USD to EUR for each transaction. You can be smart and keep an eye on the exchange rate (you can even set a limit in the Wise app) and exchange when it’s convenient for you. Hope this helps!