Wise, formerly TransferWise, is an amazing tool to save money while travelling. Over the years, we have learnt some tricks to use the multi-currency Wise debit card to the best of its capabilities and to travel safely.

Keep reading to learn our best tips to travel safely and save money with Wise!

Help me run my blog! This post contains some affiliate links: the small commission I may earn if you click through and make a purchase/booking (at no extra cost to you) will go towards supporting the site and our travels. That means more posts and useful info for you!

We only recommend products we use ourselves and believe in. Thank you for supporting Travelling Sunglasses!

Click here to read our full disclosure.

Request your Wise debit card in advance

As with everything that is not strictly under your control, play it safe and plan in advance.

It may take up to 2-3 weeks to mail the Wise debit card (formerly TransferWise Borderless card) to you. Make sure you request it well before your first trip!

If you’re still not sure if you want it, check out our review here. Otherwise, request your card now!

Watch the exchange rate fluctuations

As you plan your trip, watch the exchange rate often in order to figure out if this is a good moment to convert your money.

Of course, we aren’t financial experts who monitor the stock exchange and the world economy, but we can still make a reasonable guess.

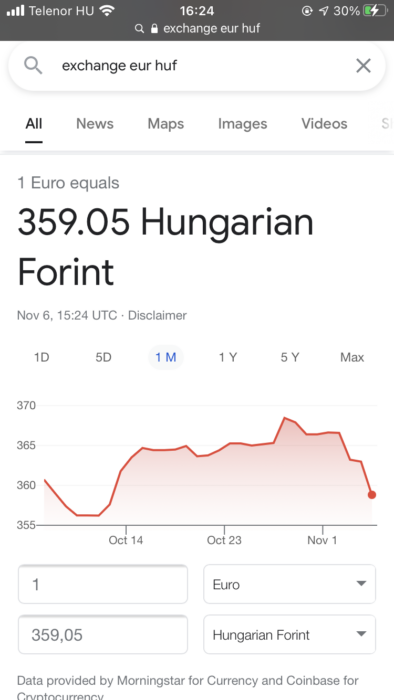

I usually type on Google the two currencies I’m interested in, like “exchange eur huf” and observe the graph.

In this case, I have Euros to exchange to Hungarian Forints. I want to get as many Forints as I can for each Euro I own. Consequently, I want to convert when the rate is high: I want to get 370 Forints for 1 Euro, instead of 340 Forints for 1 Euro.

The graph goes up and down. Right now it’s down, but it’s reasonable to expect that it will go up again, so I will wait a few days and keep checking.

I describe how to convert from a currency to another on the Wise app here.

While travelling, remember the exchange rate

This is a useful tip to save money while travelling and avoid overspending: keep the exchange rate somewhere visible, like your notes or your calendar, to be aware of how much you are spending.

From a psychological point of view, I noticed that when I had Japanese Yen or Polish Zloty available in my Wise card, I would swipe it with little concern about how much I was spending. I wanted to enjoy my hard-earned money!

But then, I was a bit shocked of how quickly it finished, eheheh.

I fixed it by keeping the exchange rate handy on my phone. If I convert the price of an attraction ticket or a meal to my currency, I am more mindful of my expenditure.

We also recommend the app Xe Currency and Money Transfer for quick calculations.

Test and explore the payments and limits on the Wise app

You have so much control on the Wise App.

How to set limits on the Wise app? On iPhone (but it must be similar on Android too):

- Open the Wise app

- Tap “account” in the menu at the bottom

- Tap “manage card”

- Tap “see limits”

- Choose ATM withdrawals, chip and PIN and mobile wallets, contactless transactions, magnetic stripe transactions, or online payments

- Toggle on top of the screen to enable or disable the payment type, and tap at the bottom to change from default amount to maximum amount. (As a European, my limits are in British Pounds; I’m not sure about other countries).

Isn’t this clever? When you are at home and not using the Wise debit card (formerly TransferWise Borderless card), you can disable all payments and stay safe from scams. This is not only a Wise travel tip, it’s also a Wise at home tip!

Even when travelling, you can keep everything disabled until you reach the cashier, or set a limit to control your spending and prevent overcharging mistakes.

Test how to add money to your Wise card on the Wise app

Before you travel, explore the different ways to add money to your multi-currency Wise account. This will come in handy if something unexpected happens and you need to add money.

This is how to add money to your Wise account from the app (on iPhone):

- Consider the currency where the money comes from, e.g. your standard Euro account

- Open the Wise app and choose the balance with the same currency, in order to avoid conversion fees

- Tap “add money”

- Choose the amount and the paying currency, which means where the money comes from

- Choose a fast transfer by card, or a bank transfer. The app will show clearly the commission.

- Complete the transaction with your card, or make the bank transfer from your online banking app.

Become familiar with this process, review it before you travel, so you will be ready for unforeseen events.

Always travel with two cards

Not strictly a Wise travel tip, but a fundamental one. As always, stay safe by travelling with two cards and keeping cash separately.

I don’t want to jinx it, but let’s be honest: you never know. Someone might steal your handbag, the airline might lose your suitcase, you may find your pockets empty.

That’s why it’s safer to keep your valuables separate. For example, keep your Wise debit card and some cash in your wallet, but leave some more cash and another card in your luggage at the hotel. Or keep the Wise card in your wallet, cash in your pocket, and the emergency card in a secret pocket in your backpack.

This way, whatever happens, you have a plan B.

Final thoughts

It’s very easy to feel safe when travelling with Wise, formerly TransferWise. With just a few pointers, you can travel freely and happily!

We wrote a complete review of Wise and the multi-currency card, as well as some travel stories of how we use Wise. I’m sure they will be useful to you! Check them out!

Are there other ways for you to travel safely? Share your advice in the comments 🙂