Wise (formerly TransferWise) has improved the way we travel in a radical way. In this post, you will learn how Wise works, why the Wise debit card (formerly TransferWise Borderless card) is the best card to travel, and how to sign up and start saving money!

We have been using the Wise debit card to travel since 2018. To say we are huge fans is an understatement: as soon as we start planning a new trip, I open a new currency balance on the Wise App. We are sure you will love it too!

Help me run my blog! This post contains some affiliate links: the small commission I may earn if you click through and make a purchase/booking (at no extra cost to you) will go towards supporting the site and our travels. That means more posts and useful info for you!

We only recommend products we use ourselves and believe in. Thank you for supporting Travelling Sunglasses!

Click here to read our full disclosure.

Why you will like Wise

Does this sound familiar?

- You withdraw cash from an ATM abroad, and days later you find an unexpected fee on your balance.

- You withdraw cash from an ATM abroad and the exchange rate is ridiculous! Thieves! You even calculate what you could eat or drink with the money you are losing to these buffoons.

- You try to pay with your card abroad, but the card is blocked for security reasons. Even though you told the bank you were going to travel.

- You pay with your card abroad, and the waiter/shop assistant informs you of the fees and commissions due to the different currency. What you were going to buy suddenly becomes more expensive.

- As you prepare the budget for your trip, you know that you will spend also on fees and commissions from your bank… And this breaks your heart.

- You are scared that your bank card will be cloned or stolen. It’s connected to your main bank account!

If you work hard to save money for your travels, the Wise multi-currency account is the service for you. All your money problems will be fixed, thanks to a simple service with low and transparent fees.

What is Wise and how does it work?

Let’s start with the basics: with a Wise account, you can send and receive money from abroad, as well as spend it in different currencies around the world, with lower fees compared to traditional banks, and with the official mid-market exchange rate.

If you send or receive money from abroad through Wise, they keep it cheap because the money does not actually cross the border: my Euros go to the Wise central account in EUR, and then the Wise central account in USD releases the equivalent in American Dollars to my friend. No international fees! During the process, you will read clearly the official exchange rate used and the commission they apply.

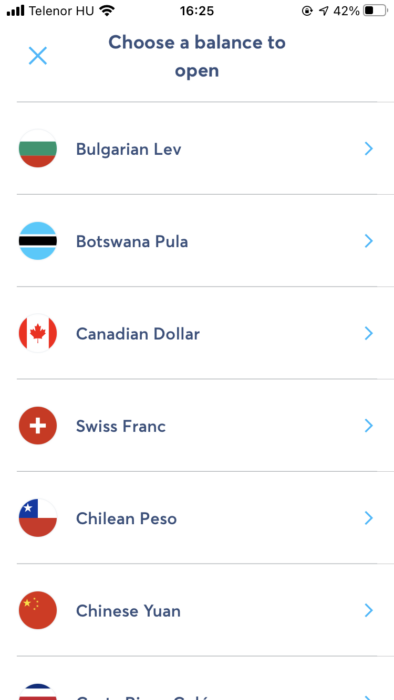

The Wise multi-currency account, (formerly TransferWise Borderless account), allows you to open balances in 50+ different currencies. This means that in just one debit card, for example, you can have balances in Euros, US Dollars, Polish Zloty and Japanese Yen. Some of them, like Euro, British Pound, US Dollar, Australian Dollar, New Zealand Dollar and Singapore Dollar even come with a bank number for bank transfers. Just like with transferring money, when you exchange money within your account from a currency to another you can read clearly the official rate and the fee. And the exchange is immediate.

Do you see how amazing this is? Banks and exchange offices always have different rates for selling and buying currencies, as well as more fees and commissions (even when they advertise 0% commission fee!). It is extremely complicated to figure this out before exchanging the money, so you usually realize only afterwards how much you spent (or better said, lost).

Wise makes exchanging and sending money super fast, cheap and clear.

Wise for travel: the multi-currency account and debit card

As travellers, the Wise multi-currency debit card changed our lives.

Let’s get practical: without Wise, we would pay our accommodation, food and tickets with the normal debit card, withdraw cash from ATMs, or bring cash with us to exchange on spot. Each of these transactions would cost us a fee and the exchange rate difference. Even on a short city break, we would waste 20-30 EUR this way!

Instead, travelling with Wise is so much easier.

We usually prepare for a trip abroad like this:

- We calculate a first budget of how much we will spend of accommodation, transportation, entrance tickets, and some food.

- If we are being very meticulous (like for our honeymoon in Japan), we monitor the exchange rate for a few days and convert our money into the travel currency when it looks like a good deal.

- If we are in a rush, e.g. we are already booking the hotel, we just convert it there and then on the Wise app.

- Done! We exchanged a big amount of money with the best exchange rate and a small, fair commission. Now we can continue paying by card without any other fees, or we can withdraw cash from a local ATM.

What if you finish the local currency on your card during your trip? Just convert some more, it takes a second from the Wise app! If you have any left at the end, exchange it back to your home currency (and in this case, why not monitor the exchange rates and try to get the best deal.) If you don’t exchange it, your payments will use the first currency you have available (for me, Euro).

What if you finish all the money on your Wise card during your trip? I usually add money through the app from my traditional debit card. This takes a few seconds, and then a few more to exchange it into a new currency. You can also do a traditional bank transfer from your online banking system.

Don’t believe us? Here are our real stories of using Wise for travel!

Why is Wise useful for travellers?

Need more insight? As travellers, we use Wise because:

- It is transparent: I’m too shy or I don’t have time to ask for commissions and fees in advance at a shop or restaurant, so I would just end up losing money. I love that Wise shows upfront all details of my conversion or transfer.

- It is fast: it’s really easy to become familiar with the app, and then converting and transferring money is super fast.

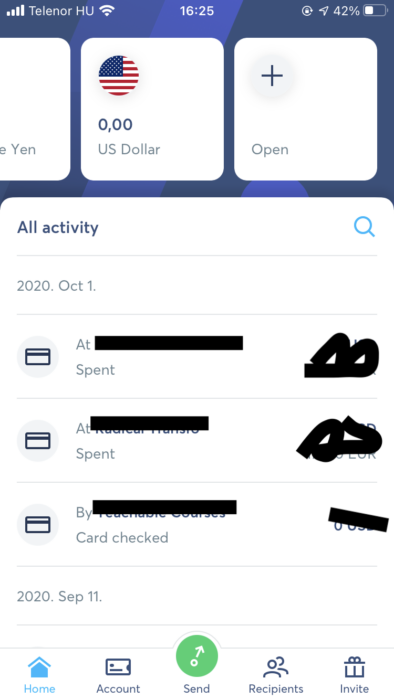

- It holds different currencies: with fewer and lower fees, I worry less and I feel more like a local! It is also easier to keep track of all expenses during the trip, because the history and balances are always visible.

- The Wise app is great: since there are no offices to walk into, they made the App intuitive, easy to use, and safe.

- The customer service is helpful: I had a couple of unclear situations during these 3 years, and the customer service team was very fast and competent in solving them, even though they were not even Wise’s fault.

Looking for more? Here are all our efficient travel tips!

How to request the Wise multi-currency debit card

Signing up with Wise and requesting the card is easy, but it may take 2-3 weeks. Plan this before you travel.

These are the steps (which may change slightly as Wise update and improve their website):

- Click here to go over to Wise (and I will receive a small commission after your first transaction. Thank you!)

- Click on GET AN ACCOUNT IN MINUTES and insert all your data. Your country of residence will be requested. Opening an account is free, and you get a bank account immediately.

- Once your account has been created, request the card (as of March 2021, it is available for Wise account-holder residents in the UK, US, Australia, New Zealand, Singapore, Switzerland and EEA; the cost is 5 GBP or 7 EUR or a similar amount). This is a Mastercard debit card. You have to provide an ID, a picture of you holding the ID, and proof of address. Regulations, availability and prices may change and be updated from country to country; read more here.

- If I remember correctly (I helped Darek and my father request theirs), an initial payment may be required to start the process, and you will find it in your balance.

- Wait a couple of weeks to receive your card in the mail, and then do a happy dance 🙂

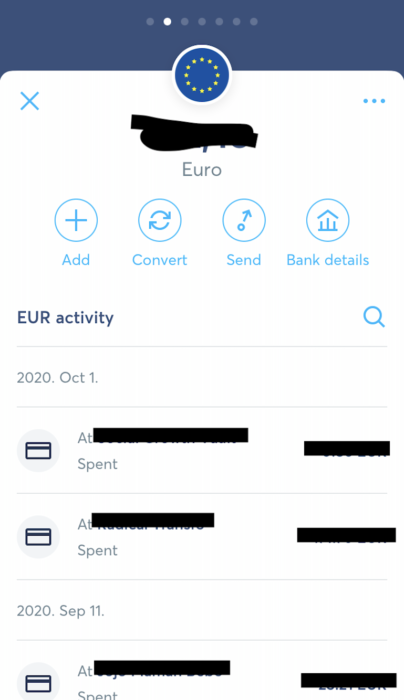

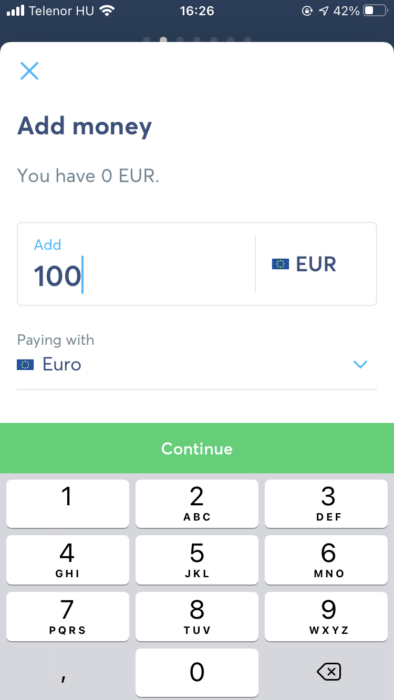

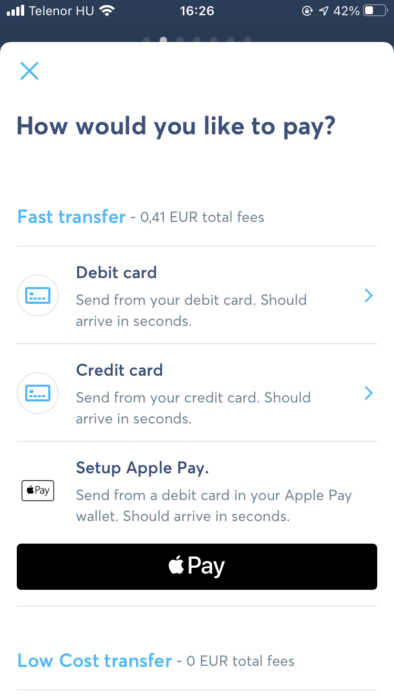

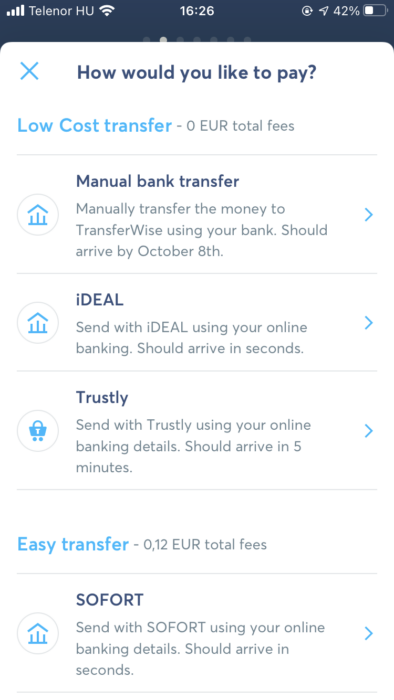

How to add and convert money on the Wise app

This is also incredibly straightforward. Check out the screenshots below I made from the app on iPhone.

First of all, download the Wise app from your store, and log in.

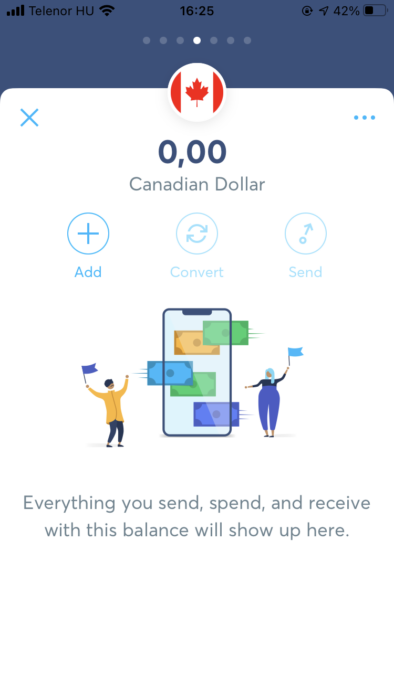

To open a new balance in a new currency, scroll to the right and tap the “+” sign. Choose the new currency. Done!

To add money to an existing balance, tap on it and then tap on the “+” sign. Choose how much money to add and from which currency it originates. Continue and you will be able to choose how to add money: by debit card, or credit card, or bank transfer… You will also read how long it will take, between seconds and a day. Done!

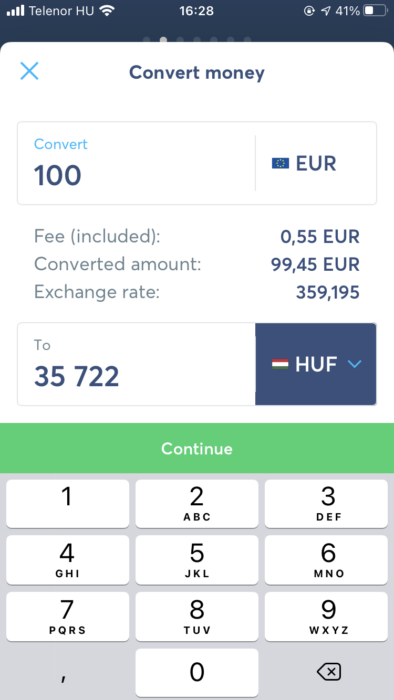

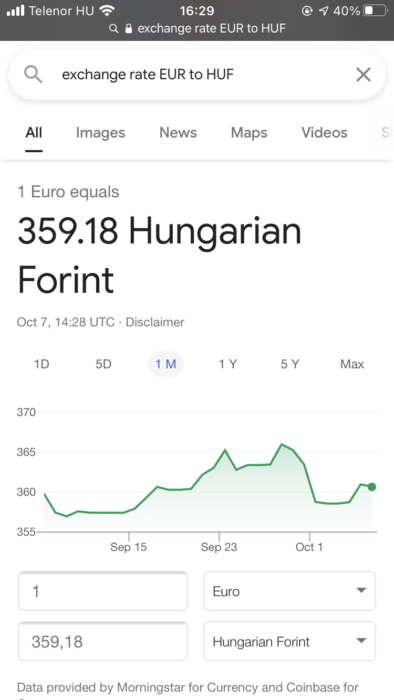

To convert money from a currency into another, start by tapping on the original currency. Here I’m exchanging Euro into Hungarian Forints. Choose how much money you want to convert. The app shows the fee, the exchange rate, and the final result. It’s guaranteed to be the same mid-market exchange rate you see on Google. Tap “Continue” and done!

Find here more useful and practical Wise travel tips.

Are there any fees?

Lately, some fees for withdrawing money have been introduced. Dependent on where your card was issued, the first 200 GBP, 250 USD, 350 AUD, 350 NZD, or 350 SGD that you withdraw every month is free. If your card was issued to you in Europe, the home currency is GBP. After, the charge on withdrawals is 2%.

Be careful, ATMs may charge fees too. For example, EURONET ATMs always charge extra fees, so just avoid them altogether. Wise suggests using this Mastercard locator tool by selecting “View more options” and then “No access fee (within country)” to find ATMs. If the ATM offers to convert money for you, they will cheat with a bad exchange rate!

Is Wise safe?

Yes. Wise (formerly TransferWise) is an authorised Electronic Money Institution independently regulated by the Financial Conduct Authority (FCA) in the UK.

The Wise debit Mastercard® is issued by Wise Ltd under license by Mastercard International Inc. Mastercard is a registered trademark, and the circles design on the card is a trademark of Mastercard International Incorporated. Find out more here.

Should you get the multi-currency Wise debit card?

Of course! Wasn’t this beaming review enough? Get it now by clicking here.

You may also be interested in real-life stories of how we use Wise, and some Wise travel tips we learned over the years.

Do yourself a favour and start saving money while you travel! Think of me when you enjoy that extra croissant or glass of wine, which would have been wasted on bank commissions.

Let us know below what you think!